Junior ISA

The tax-efficient way to gift money to a child.

Our Junior ISA is designed for parents, grandparents or legal guardians to save money for your child's future.

Benefits

Invest in your child’s dreams with our Junior ISA account, where every contribution paves the way for a promising future.

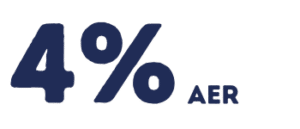

- Earn a highly competitive 4% AER/gross fixed on your savings.

- Subject to Annual Allowance of £9,000 each tax year.

- Funds cannot be touched until the child turns 18.

- Includes free life savings insurance (T&Cs apply).

- Savings up to £85,000 are protected by FSCS.

Junior ISA Rules

- Junior ISAs can be opened by a registered contact who is older than 16 and has parental responsibility for the child.

- ISA applicants must be ordinarily resident in the UK for tax purposes.

- The current annual allowance for a Junior ISA is £9k. For JISA holders aged between 16 and 18, it is possible to have both a Junior ISA and Cash ISA. You can save up to £20,000 in one type of ISA annually or split the allowance across some or all types. E.g. you could save £15,000 in a Cash ISA, £2,000 in a Stocks and Shares ISA (not offered by ETA) and £3,000 in a Lifetime ISA (not currently offered by ETA). As is stands, it’s not applicable to JISA holders, unless they are over 16 because they cannot open the other accounts.

- An initial deposit of at least £5 is asked to open a EuroTrust Credit Access Junior ISA

- You cannot subscribe to more than one Junior Cash ISA provider in any one tax year.

- You can subscribe by lump sum, regular or irregular payments.

- Junior ISAs can be transferred to another provider at any time.

- The child cannot have a Child Trust Fund (CTF) and a JISA. Not an issue for those born after January 3, 2011. Applicable to some under 18s born prior to this date. CTFs must be transferred in full to a JISA.

- We accept Junior Cash ISA transfers in from other providers using the ISA Transfer Service (any transfer into ETA should not exceed £85,000).

- Read full terms & conditions

Open a Junior ISA

Prefer to speak to us?